WASHINGTON — The conference table at the center of Radha Plumb’s Pentagon office has two large maps sitting underneath a glass plate. One is of Taiwan, and the second Ukraine.

There’s hardly a better image of the demands faced by her staff. As deputy undersecretary of defense for acquisition and sustainment, Plumb is responsible for helping solve some of the Defense Department’s most vexing problems, from increasing industrial capacity to reforming the arcane Foreign Military Sales process.

Those tasks also involve supporting U.S. allies and partners — notably Ukraine, Taiwan and Israel.

The job has stretched the U.S. military’s stockpiles and challenged its ability to refill them; the White House has requested a $106 billion supplemental to address these problems.

Plumb spoke with Defense News on Nov. 7 about that funding request, U.S. security assistance and the Pentagon’s relationship with Capitol Hill. This interview was edited for length and clarity.

What is your focus as we enter a new year?

We’re focused on three big areas. The first is our industrial base. The conflict in Ukraine revealed fragility in that industrial base. Where we’re focused is really demonstrating that it has responded shockingly well.

Take 155mm artillery rounds as an example: We doubled production in the last 12 months. We’re looking to get to the point where we produce 80,000-100,000 by the end of 2025. And we’re doing that on lots of systems — Guided Multiple Launch Rocket Systems, Patriots, Javelins.

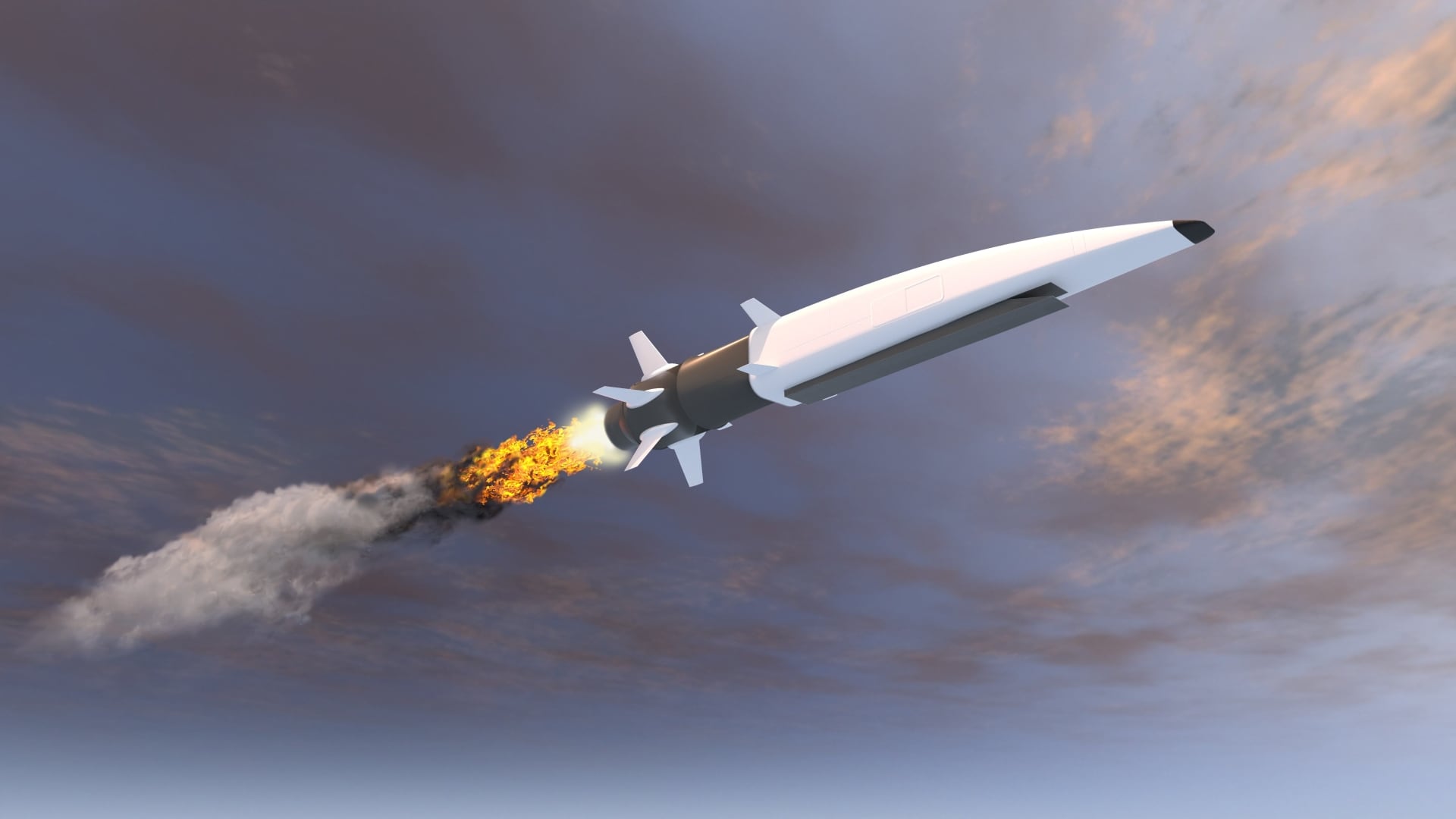

The second big area is production diplomacy. We’ve made use of our allies and partners through a range of activities over the last several years, and it’s clear there’s a lot we can do with them. Under Secretary of Defense for Acquisition and Sustainment Bill LaPlante has focused on his role as the national armament director with both the Ukraine Defense Contact Group and NATO, but also more broadly on co-development, co-production and co-sustainment. We have a partnership with Japan on the glide phase interceptor [for hypersonic defense], looking at co-development and the pre-deployment phase. In co-production, we’re working with Australia on the Guided Multiple Launch Rocket System. And on co-sustainment, we’re also working with Australia on a range of capacities and building on some of the work for AUKUS [the trilateral security agreement between Australia, the United Kingdom and the United States]. That lets us have a different version of industrial base expansion.

The third big area is a consistent demand signal to industry. A lot of folks would think: “You have a large base budget, you buy lots of stuff in the department — that should be a signal to industry.” But what industry actually pays attention to is contracts. The faster we get things on contracts and the more predictable the funding can be, the better off we are.

We’re also working with Congress on a bunch of things that let us provide a longer-term, more consistent signal — multiyear procurements, economic order quantities, advanced procurements and a bunch of industrial base capacity expansion. At the end of the day, that’s what we’re looking to measure — surge capacity, but also resilience to unexpected events in the outside world.

“Consistent” and “predictable” do not come to mind when thinking about the appropriations process this year. To what extent does that process affect your ability to send a consistent demand signal?

It’s not good. Many of us who have been doing this for a while are used to having these continuing resolutions. We’re seeing increased delays and higher levels of churn. The problem with continuing resolutions is we can’t do new contracts, at the very least. That means subcontracts to suppliers can’t happen. Ultimately it means you can’t hire a workforce. That means if you have supply chains where there are cross-dependencies, you’re growing exponentially in delays rather than linearly.

For example, for 2024 we have some counter-unmanned aerial system investments planned, with a planned delivery in the 2024-2025 time frame. Let’s say we delay the continuing resolution; we get a 90-day delay. That 90 days means once the appropriation is received, we need to notify Congress. That’ll add another month. You’re now 120 days in. Then you’ve got to finish negotiating the contract, award the contract and then start making the advanced procurements. That’s four to eight more weeks. Then you add onto that the subcontract, so that’s another two to four weeks. That assumes that the delays, which maybe the prime contractors can absorb, don’t hit subcontractors particularly hard because they need the cash flow. We’re looking at 90- to 200-day delays in key systems that we know we need for the safety and security of warfighters — [all of which happened] because we just can’t get to a deal on appropriation.

The president’s supplemental request includes $50 billion for the defense-industrial base. What would that mean for the U.S. economy and the rate of production?

The first thing it looks like is a strong signal to the industrial base that we are going to continue to invest in these capabilities to buy back both U.S. readiness as well as support allies and partners. That continued drumbeat of investment allows industry to put its own skin in the game in terms of capital investments. The signal value is incredibly powerful, especially right now, to feel like this is not caught up in D.C. turmoil.

The second piece of it is the dollar flow. That means that industry literally starts building factory lines, moving in machines and hiring for its workforce; that has community benefits. We’re starting to look at where those dollars are flowing geographically because there is an economic infusion happening in many states across the country, particularly across the Midwest and the South. That has a meaningful economic impact right now in those local communities.

The place America is in manufacturing didn’t happen overnight, and we’re not going to get out of it overnight. Part of getting us into a resilient and robust manufacturing state of play involves making sure we can build those communities and those local investments so that you have the workforce, you have the people and you have the capital infrastructure.

The Defense Department has said supporting Taiwan and Ukraine is not a zero-sum game. But with Israel now at war, how has the situation changed?

Can we do all of these conflicts simultaneously? Absolutely. There’s some overlap in systems or some underlap in systems, and the two things that revealed are, one, that we really do need this manufacturing investment. I don’t want to sugarcoat the fact that there is fragility there.

The other piece is that in all of these conflicts, there is this high-tech/low-tech combination. Take Ukraine as an example: You’ve got trenches being dug out with mortars. You’ve also got a complex electronic warfare environment. In Israel, there is a range of tactics that look very familiar to folks who lived through all of the counterterrorism operations in the past, with a lot more targeting and specialized techniques. That’s a reminder for us in the department that our strategy is to increase production, but it also has to be about encouraging advanced techniques.

Talk about the upcoming National Defense Industrial Strategy and what it might contain.

What the strategy is intended to do is connect high-level policies to specific actions that the department is going to take, and then [help determine] how we want to measure progress.

Defense Secretary Lloyd Austin tasked a tiger team to make recommendations for improving the Foreign Military Sales process. What has come of that?

On the acquisition and sustainment side, we have two big areas we’ve been working on. One looks at procurement award lead time, where we’re looking to set baseline metrics and then track contracting cycle timelines more closely to try to improve responsiveness. We’ve collected the data and we’re setting the baselines. The goal in the next 12 months is to [determine whether the procurement lead time impacts FMS or is not a real cause of delay].

The second big area is aggregate demand work. What has been happening to date prior to the FMS tiger team is we sent our demand signal to industry. Other countries have their demand signal that pre-negotiates with industry, and the industry aggregates it all up. But everyone has a piece of information, and no one has the total information. We’re working with our partners in the Defense Security Cooperation Agency and our prime industry partners to basically create an aggregate demand picture in a set of priority munition areas that are relatively high-demand areas.

[That group] is identifying the high-demand areas, some of which are related to air defense and key munitions, and then figuring out the process to get that aggregate demand — the key being you don’t want to wait all the way until you have a formal letter exchange, but you don’t want to do it too early and skew the demand process.

We’re entering a year when U.S. military stockpiles will probably experience extreme demands. What is the state of those stockpiles?

Thinking about the stockpile is thinking about it from the supply side, but the way I’d rather think about it is on the demand side. We know that our partners have demands for certain kinds of capabilities. A lot of the work our acquisition and sustainment team does with our partners in policy and with the combatant commands is [about fulfilling a materiel need] by looking across the range of systems we have in our stockpiles, and what is hot on production lines, and where can we rapidly increase production and reprioritize deliveries to meet the aggregate demand.

Stockpiles are a thing we manage strategically to maintain readiness. You’ve heard everyone from the president on down to Dr. LaPlante say we’re going to prioritize the readiness of our forces. But we have a lot of tools at our disposal to meet different demands.

Noah Robertson is the Pentagon reporter at Defense News. He previously covered national security for the Christian Science Monitor. He holds a bachelor’s degree in English and government from the College of William & Mary in his hometown of Williamsburg, Virginia.